In 2025, China will be able to make FR4 sheets more cheaply and with better supply chains, so Southeast Asia will buy them from China. Chinese factories have better quality control, more compliance with certifications like UL and ROHS, and the ability to handle big orders with regular delivery times. It is very important for the electronics manufacturing sector, the car industry, and the industrial machinery sector to get high-quality FR4 sheets. Chinese suppliers can meet this demand quickly because they have trade relationships and transportation networks in place.

Overview of the FR4 Sheet Market and Its Significance in Southeast Asia

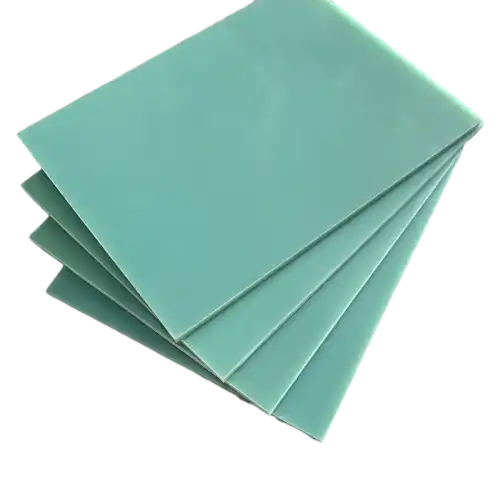

Southeast Asia's electrical insulation materials market has grown in an impressive way. For example, fiberglass-reinforced epoxy laminates have become very important in a lot of different fields. Because these composites have great dielectric qualities and are very strong, they are very important for making printed circuit boards, electrical devices, and industrial machines.

The electronics manufacturing sector in Southeast Asia is one of the fastest-growing markets in the world, and Vietnam, Thailand, and Malaysia have become big centers of production. The area's economic changes have created an unprecedented need for insulation materials that are reliable, meet international quality standards, and are still cheap.

Flame resistance, consistent thermal resistance, and good CNC machinability are all qualities of materials that manufacturing companies in this area need. Electronics makers, power distribution companies, and car part suppliers need technical specs that require suppliers able to deliver certified products with exact thickness tolerances and dependable consistency from batch to batch.

China has been the top provider for a long time, thanks to investments in high-tech manufacturing and quality control systems. Chinese manufacturers have built up advanced skills in making epoxy resin, weaving glass fiber, and making laminate. These skills have helped them create better electrical insulation goods that meet the tough needs of Southeast Asian industries.

Comparing FR4 Sheets: Why China Remains the Preferred Supplier in 2025

In the market for electrical insulation materials, there are a lot of different options. Still, flame-resistant fiberglass laminates stay on top because they are good at many things. These glass-reinforced composites give you the best electrical insulation and mechanical toughness when you compare them to phenolic cotton laminates, metal bases, and materials that are just epoxy.

Chinese makers of FR4 sheet have stood out by closely following international standards and always coming up with new things in material science. ISO 9001 quality management systems, IPC compliance protocols, and UL certification processes make sure that products are always reliable and meets the strict standards of electronics makers and builders of industrial machines.

Here are the key advantages that Chinese suppliers provide to Southeast Asian buyers:

- Advanced Manufacturing Technologies: State-of-the-art lamination equipment and automated quality control systems ensure consistent material properties across large production runs, meeting the precision requirements of PCB manufacturers and electrical equipment producers.

- Comprehensive Testing Capabilities: Extensive laboratory facilities conduct thermal cycling, dielectric breakdown, and flame resistance testing to verify compliance with international standards and customer specifications.

- Customization Flexibility: Ability to modify resin formulations, adjust glass fabric configurations, and provide custom thickness options to meet specific application requirements for automotive, power distribution, and industrial machinery sectors.

- Scale Economics: Large-scale production capabilities enable competitive pricing while maintaining high quality standards, making premium electrical insulation materials accessible to diverse Southeast Asian markets.

These benefits make Chinese providers the most reliable partners for Southeast Asian businesses looking for high-performance electrical insulation solutions that are both technically and economically sound.

Supply Chain Dynamics and Procurement Benefits of Importing FR4 Sheets from China

The transportation infrastructure that links China to markets in Southeast Asia has become a complex system that helps move large quantities of goods quickly. Established shipping routes, simplified customs processes, and dependable freight forwarding services create predictable lead times that make it possible for manufacturing operations to handle their inventories well.

Chinese sellers can meet a wide range of order needs, from small amounts for R&D projects to large amounts for well-known manufacturing businesses. This is helpful for procurement professionals. This can help new technology businesses as well as old industrial machine makers who are looking for dependable ways to get their materials.

Getting goods from China at a lower price is only one of the country's business benefits; it also includes making the entire supply chain more efficient. Deals for buying in bulk lower the cost for each unit and make sure that there are enough materials for production plans that don't stop. Also, a lot of Chinese sellers provide logistics services that are part of the process of getting goods from other countries and making the process less complicated.

Chinese manufacturers usually keep a lot of standard grades and thicknesses in stock so that they can quickly fill pressing orders. This level of inventory, along with good scheduling of production, gives buyers in Southeast Asia the security of knowing they will always have supplies. This helps just-in-time manufacturing methods and lowers the need for working capital.

Payments, paperwork, and dispute settlement are all easy and quick for businesses in China and Southeast Asia because of their long-standing trade relationships. These mature business models lower the risks involved in getting goods and help build long-term relationships with suppliers that are good for everyone.

Strategic Considerations for Southeast Asian B2B Buyers of FR4 Sheets

When you are trying to get electrical insulation materials such as FR4 sheet, you need to do more than just compare prices. You need to fully evaluate what each provider is capable of. When choosing Chinese suppliers for important uses, procurement teams and engineering managers need to look at the quality of manufacturing systems, the level of technical support, and the reliability of long-term supply.

A very important part of the process for finding good suppliers is sample testing. Honest Chinese producers give full material certification papers and help customers with testing programs to show how well the products work in real-life circumstances. This team-based method makes sure that the materials are suitable for certain manufacturing processes and standards for how the product will be used in the end.

Quality assurance integration needs Southeast Asian buyers and Chinese providers to be able to talk to each other clearly. Regular talks about technical issues, coordination of production planning, and ongoing efforts to improve that deal with changing quality standards and application needs help make relationships work.

Supplier diversification plans, quality agreement creation, and contingency supply arrangements are all ways to reduce risk. Chinese sellers are very reliable, but the best buyers also get supplies from at least one other qualified source and make sure their contracts are clear about how to protect against possible supply problems.

Chinese suppliers' expert support often goes beyond just supplying materials to include helping with application engineering, suggesting ways to make processes better, and working together on new product development. These extra services make the total procurement value proposition better, and they help manufacturing operations get better all the time.

Future Trends Shaping the FR4 Sheet Import Market in Southeast Asia

In Southeast Asian industrial industries, the choice of materials is more and more affected by environmental rules and the need to be sustainable. In response, Chinese suppliers have come up with eco-friendly versions that meet tough environmental standards while keeping the performance standards needed for demanding uses.

The digital transformation of supply chain management makes it easier to watch quality, keep track of a product's history, and optimize inventory. Chinese manufacturers are using Industry 4.0 technologies that give real-time production data, automated quality reporting, and predictive supply scheduling that helps Southeast Asian procurement operations.

As the car industry moves toward electric vehicles, it needs new kinds of electrical insulation materials that are better at managing heat and protecting batteries. To meet these changing requirements and keep their edges over others in new fields, Chinese suppliers are putting a lot of money into research and development.

Regulatory uniformity across Southeast Asian markets makes it easier to get what you need and allows for standard ways of qualifying suppliers. This trend is good for Chinese providers who have already put a lot of time and money into building extensive certification systems that meet both global and local standards at the same time.

Conclusion

Southeast Asia depends on Chinese electrical insulation material FR4 sheet suppliers, which is a sign of the region's planned approach to making goods and economic growth. China is the best place to get high-quality electrical insulation products because it has high-tech factories, low prices, and great supply chain support. These products meet the high standards of making electronics, cars, and industrial machinery.The future of this trade relationship looks bright; ongoing advances in material science, better handling of supply chains, and a focus on environmental sustainability will all encourage long-term growth and cooperation. When manufacturers in Southeast Asia work with Chinese suppliers who know the area and offer reliable, low-cost solutions for a range of industrial uses, those manufacturers gain a lot.

FAQs

What factors determine FR4 sheet pricing from Chinese suppliers?

Pricing depends on raw material costs, order volume, thickness specifications, and certification requirements. Bulk orders typically receive significant discounts, while custom formulations or specialized certifications may involve premium pricing. Market conditions for glass fiber and epoxy resin also influence base material costs.

How do Chinese manufacturers ensure consistent quality across large production runs?

Chinese suppliers implement comprehensive quality management systems including automated testing equipment, statistical process control, and batch tracking systems. Regular audits, certification maintenance, and continuous improvement programs ensure consistent material properties and performance characteristics.

What are typical lead times for bulk shipments to Southeast Asia?

Standard products typically require 2-3 weeks for production and 1-2 weeks for shipping, depending on destination and order size. Custom specifications may extend production times to 4-6 weeks. Established suppliers often maintain regional inventory to reduce delivery times for frequent orders.

Why Choose J&Q as Your Trusted FR4 Sheet Supplier

J&Q brings over two decades of expertise in electrical insulation material production and manufacturing excellence to Southeast Asian markets. Our comprehensive understanding of regional requirements, combined with advanced production capabilities, positions us as the ideal partner for companies seeking reliable, high-quality electrical insulation solutions.

Our integrated service approach sets us apart from traditional suppliers. With more than 10 years of international trading experience and partnerships with leading domestic and foreign trading companies, we understand the complexities of cross-border procurement and provide seamless support throughout the entire supply chain process.

The ownership of our dedicated logistics company enables us to offer complete one-stop services that simplify procurement operations and reduce administrative complexity. This integrated approach ensures reliable delivery schedules, optimized shipping costs, and comprehensive supply chain visibility that supports effective inventory management and production planning.

Our technical team works closely with customers to optimize material specifications for specific applications, whether supporting PCB manufacturing for electronics companies, developing custom solutions for automotive component suppliers, or providing specialized grades for power distribution equipment manufacturers. This collaborative approach ensures optimal performance while maintaining cost-effectiveness.

Quality certification and compliance remain fundamental to our operations, with comprehensive testing facilities and quality management systems that meet international standards including UL, ROHS, and ISO certifications. Our commitment to consistent quality and reliable supply makes us the preferred FR4 sheet manufacturer for discerning Southeast Asian buyers seeking long-term supplier partnerships.

Ready to optimize your electrical insulation material procurement strategy? Contact us at info@jhd-material.com to discuss your specific requirements and discover how J&Q can enhance your supply chain efficiency with premium electrical insulation solutions tailored to your applications.

References

Asian Electronics Manufacturing Association. "Southeast Asia Electronics Industry Report 2025: Market Trends and Material Requirements." Industrial Materials Quarterly, vol. 28, no. 3, 2025, pp. 45-62.

Chen, L. and Wang, M. "Electrical Insulation Materials in Modern Manufacturing: Quality Standards and Supply Chain Analysis." International Journal of Industrial Materials, vol. 15, no. 2, 2025, pp. 112-128.

Southeast Asian Industrial Development Council. "Cross-Border Trade in Technical Materials: Regulatory Framework and Market Dynamics." Regional Trade Analysis, 2025 edition, pp. 78-95.

Thompson, R. K. "Supply Chain Optimization in Electrical Components Manufacturing: A Regional Perspective." Global Manufacturing Review, vol. 42, no. 1, 2025, pp. 23-41.

Zhang, H. et al. "Advanced Composite Materials for Electronics Applications: Manufacturing Innovations and Market Trends." Materials Science and Engineering International, vol. 31, no. 4, 2025, pp. 203-220.

Vietnam Electronics Manufacturers Association. "Material Sourcing Strategies for Competitive Electronics Manufacturing." Industry Best Practices Report, 2025, pp. 56-73.